Life Insurance in and around Clinton

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Protect Those You Love Most

The standard cost of funerals in America is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your family to cover those costs as they face grief and pain. That's where Life insurance with State Farm comes in. Having the right coverage can help your family afford funeral arrangements and not fall into debt.

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Put Those Worries To Rest

You’ll get that and more with State Farm life insurance. State Farm has terrific protection plans to keep your family members safe with a policy that’s adjusted to align with your specific needs. Fortunately you won’t have to figure that out alone. With personal attention and excellent customer service, State Farm Agent Kara Howe walks you through every step to create a policy that protects your loved ones and everything you’ve planned for them.

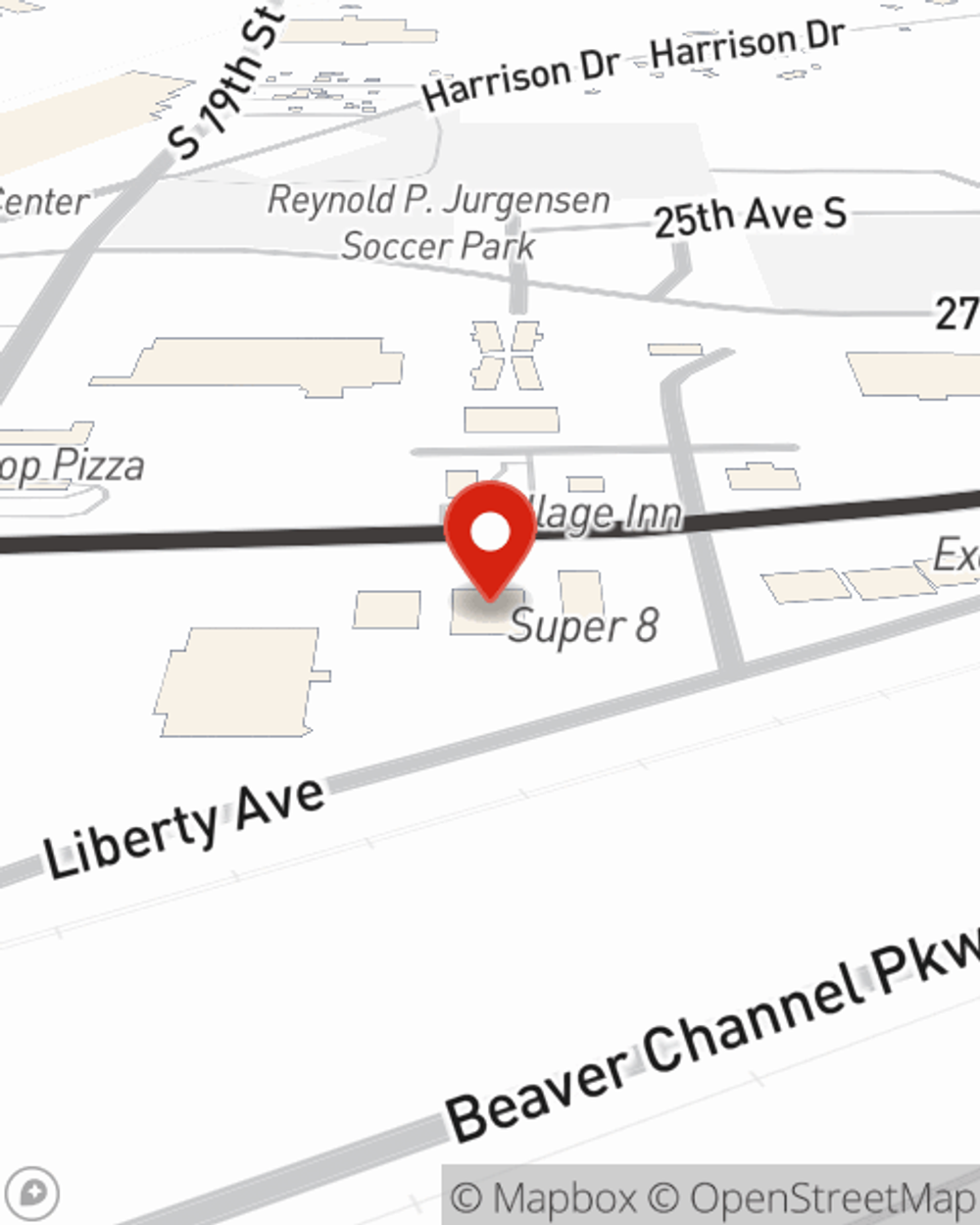

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to find out what the State Farm brand can do for you? Reach out to State Farm Agent Kara Howe today.

Have More Questions About Life Insurance?

Call Kara at (563) 242-3400 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.